Monthly Recurring Revenue is the predictable monthly income from subscriptions, calculated as the Average Revenue Per User (ARPU) per month multiplied by the number of paying customers. It normalizes various pricing plans into one figure, aiding in revenue forecasting, growth tracking, and strategic business decisions.

How to Calculate MRR?

MRR Equation = ARPU x Number of Paying Customers

Average Revenue Per User (ARPU):

The average amount of revenue generated per user in a month. This can be calculated by dividing the total monthly revenue by the total number of paying customers.

Number of Paying Customers:

The total number of customers who are currently paying for the subscription. This includes all active subscriptions regardless of the billing cycle (monthly, quarterly, annually).

Variables to Consider in MRR

To accurately reflect the true Monthly Recurring Revenue, MRR calculations should account for various factors that impact subscription revenue, known as MRR Movement Variables:

- New Business MRR: Revenue from new customers.

- Expansion MRR: Revenue from existing customers upgrading their plans.

- Contraction MRR: Revenue loss from downgrades.

- Churn MRR: Revenue loss from cancellations.

- Reactivation MRR: Revenue from reactivated subscriptions.

- Clarity on New, Expansion, Contraction, Churn, and Reactivation MRR

- Drive informed decisions with detailed revenue insights

- Customize metrics to fit your subscription business needs

Detailed example of how to use Monthly Recurring Revenue Formula:

Basic Example

Let's consider a SaaS company with the following data:

- ARPU: $50 per month

- Number of Paying Customers: 100

In this basic example, the company has an MRR of $5000, representing the predictable monthly income from its 100 paying customers, each contributing an average of $50 per month.

Advanced Example

Now, let's consider a more complex scenario where the company experiences various changes in its customer base and subscription plans, including normalizing annual revenue:

- Existing MRR: $5000 (from 100 customers each paying $50 per month)

- New Business MRR: $1000 (revenue from 20 new customers, each paying $50 per month)

- Expansion MRR: $500 (additional revenue from existing customers upgrading their plans)

- Contraction MRR: -$300 (revenue loss from downgrades)

- Churn MRR: -$700 (revenue loss from 14 customers canceling their subscriptions)

- Reactivation MRR: $200 (revenue from 4 reactivated subscriptions, each paying $50 per month)

- Annual Subscriptions Normalized to Monthly: 4 customers each paying $1200 annually, normalized to $100 per month per customer

As a summary:

- Existing MRR: $5000

- New MRR: $1000

- Expansion MRR: $500

- Contraction MRR: -$300

- Churn MRR: -$700

- Reactivation MRR: $200

- Annual Subscriptions Normalized: (4 customers x $1200 per year) / 12 months = $400

Net MRR Movement:

$1000 + $500 - $300 - $700 + $200 + $400 = $1100

Calculating total MRR:

Optimize Your MRR Calculation

- Clarity on New, Expansion, Contraction, Churn, and Reactivation MRR

- Drive informed decisions with detailed revenue insights

- Customize metrics to fit your subscription business needs

Monthly Recurring Revenue FAQs:

What is Monthly Recurring Revenue (MRR) and why is it important in business?

Monthly Recurring Revenue (MRR) is a metric that represents the predictable income a business generates from subscriptions on a monthly basis. It’s a crucial metric in subscription-based businesses, especially in the SaaS industry, because it provides a steady, recurring revenue stream. MRR helps businesses forecast future revenue, plan for growth, manage cash flow, and make strategic decisions. By normalizing different pricing plans into a single monthly figure, MRR allows businesses to track performance consistently over time.

How does MRR function as a metric in the SaaS industry?

In the SaaS industry, MRR functions as a key indicator of financial health and business performance. It reflects the revenue generated from subscription services and allows companies to measure growth, customer retention, and overall success. MRR helps SaaS companies understand the impact of customer acquisitions, upgrades, downgrades, and churn.

How do you calculate Monthly Recurring Revenue (MRR) and what is the formula used?

MRR Calculation = ARPU x Number of Paying Customers

Steps to Calculate MRR:

1. Determine ARPU (Average Revenue Per User): Calculate the average revenue generated per user per month by dividing the total monthly revenue by the number of paying customers.

2. Count the Number of Paying Customers: This includes all active subscriptions regardless of their billing cycle.

3. Apply the Formula: Multiply the ARPU by the number of paying customers to get the MRR.

Example:

If a company has 100 paying customers, each generating an average of $50 per month, the MRR is calculated as follows:

What are the steps to measure MRR accurately?

1. Identify All Active Subscriptions: Ensure that all customers with active subscriptions are accounted for, regardless of their billing cycle.

2. Normalize Subscription Plans: Convert all subscription plans to their monthly equivalents. For example, annual subscriptions should be divided by 12 to get the monthly value.

3. Calculate ARPU: Determine the average revenue per user by dividing the total monthly revenue by the number of paying customers.

4. Calculate MRR: Use the formula MRR = ARPU x Number of Paying Customers to get the total MRR.

5. Include Adjustments for Changes: Account for new business, upgrades, downgrades, churn, and reactivations to ensure the MRR reflects current conditions.

How do you compute the monthly revenue from various subscription plans?

To compute monthly revenue from various subscription plans:

1. Normalize All Subscription Plans: Convert all non-monthly subscription plans to their monthly equivalents. For instance, an annual subscription fee should be divided by 12.

2. Sum Up Monthly Revenues: Add the monthly revenues from all subscription plans to get the total monthly revenue.

3. Calculate Total MRR: Ensure that the total includes any adjustments for new customers, upgrades, downgrades, churn, and reactivations to get an accurate MRR.

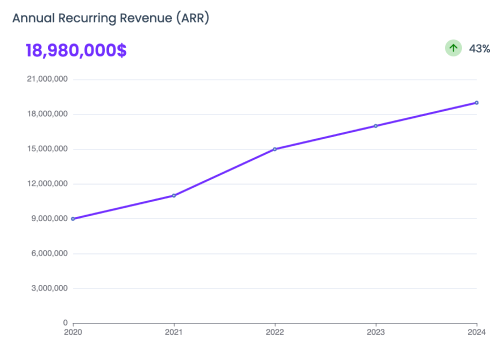

How is Annual Recurring Revenue (ARR) derived from Monthly Recurring Revenue (MRR)?

Annual Recurring Revenue (ARR) is derived from Monthly Recurring Revenue (MRR) by multiplying the MRR by 12. This conversion helps businesses understand their yearly revenue performance based on their monthly recurring income.

Formula:

ARR = MRR x 12

Example:

If a company has an MRR of $5000, the ARR is calculated as follows:

ARR = $5000 x 12 = $60,000

What is the importance of MRR vs. ARR?

MRR: Monthly Recurring Revenue is important for tracking short-term performance, making tactical decisions, and managing cash flow. It provides a granular, month-to-month view of a company's revenue trends, allowing for quick adjustments and insights.

Annual Recurring Revenue is crucial for long-term strategic planning, assessing annual growth, and evaluating overall business health. It offers a broader perspective on revenue performance, helping businesses plan for the future and make informed investment decisions.

How do you convert MRR to ARR?

To convert MRR to ARR, multiply the MRR by 12.

Formula:

Annual Revenue = MRR x 12

Example: If a company’s MRR is $8000, the ARR is calculated as follows:

Annual Revenue = $8000 x 12 = $96,000

What are the various types of Monthly Recurring Revenue (MRR) and their significance?

New Business MRR: Revenue from newly acquired customers. Indicates growth and market penetration.

Expansion MRR: Additional revenue from existing customers upgrading their plans. Reflects customer satisfaction and product value.

Contraction MRR: Revenue lost from existing customers downgrading their plans. Helps identify potential issues with pricing or product features.

Churn MRR: Revenue lost due to customer cancellations. Critical for understanding customer retention and the impact of churn.

Reactivation MRR: Revenue from reactivated subscriptions. Shows the ability to win back former customers.

Net MRR Movement: Net change in MRR, calculated as the sum of New Business, Expansion, and Reactivation MRR minus Contraction and Churn MRR. Provides a comprehensive view of MRR growth or decline.

Click here to learn more about MRR types and variables.

Why is it crucial for businesses to track Monthly Recurring Revenue (MRR)?

Tracking MRR is crucial because it provides a consistent and reliable measure of a company’s revenue performance. It helps in forecasting future revenue, identifying growth trends, making informed strategic decisions, and managing cash flow. MRR tracking allows businesses to monitor customer acquisition, retention, and churn rates, which are critical for understanding the dynamics of a subscription-based business. It also enables businesses to evaluate the effectiveness of their sales and marketing efforts and make necessary adjustments to improve financial performance.

What makes MRR a vital metric for subscription-based businesses?

MRR is vital for subscription-based businesses because it represents a stable and predictable income stream. It helps these businesses manage cash flow, plan for growth, and make strategic investments. By tracking MRR, subscription businesses can better understand customer behavior, improve retention strategies, and optimize pricing models. MRR also provides valuable insights into the effectiveness of marketing and sales efforts and helps businesses measure the success of their subscription models.

What strategies can businesses employ to increase their MRR?

Businesses can increase their MRR through several strategies:

1. Acquire New Customers: Implement effective marketing and sales strategies to attract new subscribers.

2. Upsell and Cross-sell: Encourage existing customers to upgrade to higher-tier plans or purchase additional services.

3. Enhance Customer Retention: Improve customer satisfaction and loyalty to reduce churn rates.

4. Reactivate Churned Customers: Implement win-back campaigns to regain former customers.

5. Optimize Pricing Models: Regularly review and adjust pricing strategies to reflect market conditions and customer value perception.

What factors influence the growth of MRR in a SaaS company?

- Product Quality: High-quality products that meet customer needs drive higher customer retention and satisfaction.

- Customer Acquisition: Effective marketing and sales efforts to attract new customers.

- Customer Retention: Strategies to keep existing customers, such as excellent customer service and continuous product improvements.

- Pricing Strategy: Competitive and flexible pricing models that attract and retain customers.

- Market Demand: The overall demand for the SaaS product in the market.

- Competition: The presence and actions of competitors in the market.

How can a company enhance its Monthly Recurring Revenue (MRR)?

1. Implement Targeted Marketing Campaigns: Attract new customers by focusing on specific market segments.

2. Offer Upgrades and Add-ons: Encourage existing customers to upgrade to higher-tier plans or purchase additional services.

3. Improve Customer Support and Satisfaction: Provide excellent customer service to reduce churn and retain customers.

4. Introduce Loyalty Programs and Incentives: Reward long-term customers to increase retention and encourage higher spending.

5. Regularly Update and Improve the Product: Continuously enhance the product to meet evolving customer needs and preferences.

What challenges might a company face when trying to enhance its MRR?

- High Competition: Intense competition in the market can make it difficult to attract and retain customers.

- Changes in Customer Preferences: Shifts in customer needs and preferences can impact the effectiveness of existing products and services.

- Maintaining Product Quality and Innovation: Ensuring the product remains high-quality and innovative can be resource-intensive.

- Pricing Pressures and Economic Fluctuations: External economic factors and pricing pressures can affect customer purchasing decisions.

- Managing Customer Churn: Effectively reducing churn requires a deep understanding of customer behavior and proactive retention strategies.

How does the growth of MRR reflect the overall health and performance of a SaaS company?

MRR growth is a strong indicator of the health and performance of a SaaS company. Steady or increasing MRR signifies successful customer acquisition and retention, effective pricing strategies, and overall business growth. It reflects the company’s ability to generate predictable and recurring revenue, which is essential for financial stability.

Conversely, declining MRR can signal issues with customer satisfaction, product value, or market competitiveness. Monitoring MRR growth helps SaaS companies make informed decisions, adapt strategies, and maintain long-term success.

Get started with Growslash